Calculator

%

{{ calcNVP.dataSetCount() }}

year

| Period | IC | CI | CO | CF | DCF |

|---|---|---|---|---|---|

| 0 | |||||

| {{ $index + 1 }} | |||||

| NPV |

NPV > 0, project should be accepted NPV < 0, project should be cancelled

Calculation method

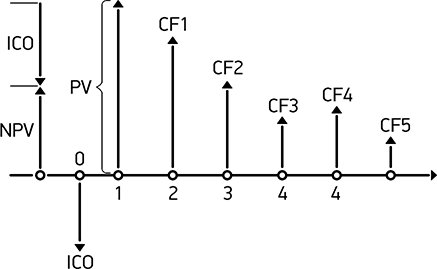

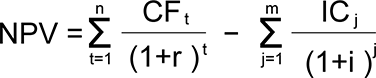

The net present value of the investment project is immediate change in the value of company when project is accepted.

ICO - Initial investment

CH n - Cash flow of n-year

NPV - Net present value

Method rule: If NPV >= 0 – project should be accepted, if NPV < 0 – project should be cancelled. When NPV is positive, the project creates value, when it's negative – destroy.