Investment calculators

calculators

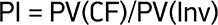

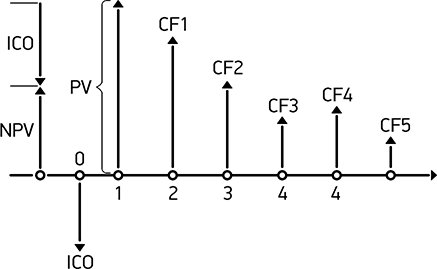

NPV calculator (Net Present Value of project)

Calculator

| Period | IC | CI | CO | CF | DCF |

|---|---|---|---|---|---|

| 0 | |||||

| {{ $index + 1 }} | |||||

| NPV |

NPV > 0, project should be accepted NPV < 0, project should be cancelled

Calculation method

The net present value of the investment project is immediate change in the value of company when project is accepted.

ICO - Initial investment

CH n - Cash flow of n-year

NPV - Net present value

Method rule: If NPV >= 0 – project should be accepted, if NPV < 0 – project should be cancelled. When NPV is positive, the project creates value, when it's negative – destroy.

DPP calculator (Discount payback period)

Calculator

| Period | IC | CI | CO | CF | DCF |

|---|---|---|---|---|---|

| 0 | |||||

| {{ $index + 1 }} | |||||

DPP (years): {{ calcDPP.calcDPPValue() | number:2 }}. Payback period is longer than expected period, it's better to reject it

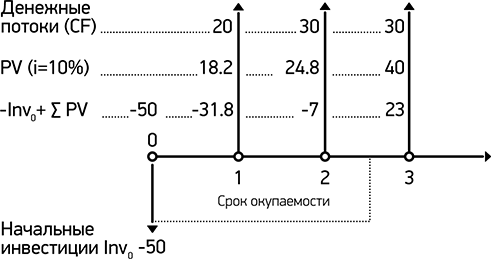

Calculation method

Payback period - is the period when cash flow exceeds invested capital.

DPP - Period when the condition will be sutisfied:

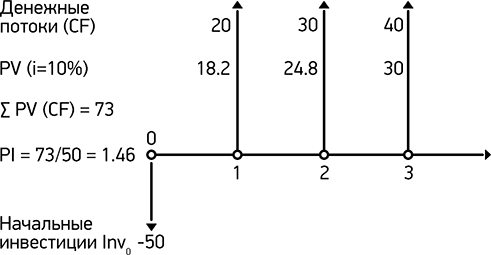

PI calculator (Profitability index of project)

Calculator

| Period | IC | CI | CO | CF | DCF |

|---|---|---|---|---|---|

| 0 | |||||

| {{ $index + 1 }} | |||||

PI = {{ calcPI.calcPI() | number:2 }}, capital investment is effective, the project can be accepted PI = {{ calcPI.calcPI() | number:2 }}, capital investment is not effective, it's better to reject the project

Calculation method

The profitability index is an index that attempts to identify the relationship between the costs and benefits of a proposed project.